Wright Cove Capital: Summer 2023

June 28th, 2023

If you are uncertain or confused about the direction of the market, don’t fret, Wall Street is in the same dilemma. In the past few days multiple research pieces were issued by analysts at major investment firms about what direction they predicted the market is heading. From Morgan Stanley to Goldman Sachs there is dramatic difference in viewpoints on future returns. Some are calling for a 10% or more sell-off, while others contend there is a new bull market upon us. The frustrations continue as the reasons behind most of these market calls make sense on both sides of the spectrum.

The bulls argue:

- Inflation has peaked.

- Interest rates have – or soon will crest, and stocks are already pricing in cuts.

- The consumer remains strong as discretionary spending remains resilient.

- Artificial Intelligence (A.I.) will be the spark that leads us into a new productivity wave.

While the bears refute:

- Inflation has only temporally subsided and will be stubbornly high for the next few years.

- Consumers may still be spending but credit card balances continue to rise.

- Corporate earnings have been strong, but mostly due to cost cuts rather than expansion.

- While AI may indeed be a transformative technology, we still don’t know who the winners and losers will be (see AOL, Netscape and MySpace).

We bring this up not to confuse clients further about the direction of markets, but rather to emphasize that trying to predict the future continues to be a fool’s game. Fortunately, our mandate is not to make predictions on where the S&P 500 will be a year from now, but rather, how to best manage portfolios based on each of our clients’ unique set of goals and circumstances.

We stand behind our positioning that being over-weight short-term US Treasuries remains the best place to be for conservative investors, or those who have liquidity needs in the near term; and equities – especially higher quality stocks – remain our favored asset class for long-term growth.

Back in February we wrote about the importance of being positioned in stocks with robust balance sheets and strong business models. We favored, “… quality growth stocks/sectors that are profitable NOW and NOT reliant on lower interest rates, lower inflation or other future circumstances to change in order to thrive.”

We were not convinced that inflation would moderate as quickly as some hoped and continued to make moves in portfolios away from unprofitable and speculative areas and focused on larger growth and quality sectors as we anticipated tighter credit conditions and persistent inflation.

What we didn’t see coming was the magnitude of this shift – and the extent to which the largest handful of companies have driven the recent rally. Not only do the 5 largest companies in the S&P 500 now account for nearly 25% of the index, but they are also responsible for nearly 75% of the returns in the index this year. In fact, according to a report from Nasdaq:

- 90% of the first quarter gains came from just 10 stocks.

- Apple, Microsoft and Nvidia accounted for nearly 50% of these gains.

Part of this move can be attributed to the fear around the debt ceiling the past few months. An argument can be made that in times of uncertainty, hiding out in the stocks of trillion-dollar companies such as: Apple, Microsoft, Alphabet (Google), and Amazon was a safer place to be than keeping money in banks or money-markets. While we disagree with this thesis from a fundamental risk standpoint, it is hard to argue with the notion that these and a handful of other mega-cap stocks have fortress-like balance sheets and strong business models.

However, the biggest driver of returns continues to be A.I., and the race to see which companies will dominate the next era of technology. The market has declared the early winners to be the chipmakers (Nvidia, AMD, Broadcom…) and the mega-cap tech conglomerates (Apple, Microsoft, Google, Meta, and Tesla to name a few). The question that comes up most recently is, “Is it too late to jump in?”

To that, we have two simple answers: Yes and No.

Before asking whether it is too late to jump into a particular sector – we believe the better question to ask is, “has anything changed on your side that warrants or merits changing your risk profile or investment plan?”

For those with a longer time horizon and/or a higher risk tolerance, quality and large-cap technology companies continue to be well-positioned to outperform over the long-haul. While valuations may be stretched in the short-term, we believe the size, flexibility, and balance sheets of larger tech companies leave them better positioned than their rival start-ups. The costs associated with A.I. processing, and the limited amount of credit (loans) available to smaller and less profitable firms make it very difficult for others to compete, creating a massive moat for the current industry leaders.

On the other hand, this is shaping up to be a textbook example of how and why many individual investors underperform markets. With all due respect to Ted Lasso, when talking about stocks and bonds, being “a goldfish” and having a short-term memory is NOT always good strategy. Many of the names that have risen 50% or more this year are the same companies that were off 50% or more last year. While we can’t predict the future, it is hard to make an argument that if a particular stock or sector didn’t fit one’s investment profile 3-6 months ago, that it now makes sense after it has rallied 50%.

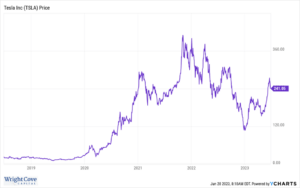

We usually talk about duration in terms of bonds – but stocks also have duration. How long one is willing or able to hold onto a growth stock is often the most important factor to success. Below is a 5-year chart of Tesla stock. Had one bought 1,000 shares 5 years ago (and held-on), that $20k investment would now be worth almost $250,000! However, if we focus on just the second half of the chart – not only is the stock virtually unchanged since January of 2021, in that same timeframe there have been moves BOTH up and down over 70%.

We highlight this chart, not because we have a particular view on Tesla, but to demonstrate what volatility looks like and what can and has happened in the recent past. Tesla has proven to be both resilient and volatile, but for those who jumped in, and didn’t have the resolve to hang on, it wasn’t a fun ride.

Is it too late to jump into this market or to chase the A.I. technology boom? That all depends upon your time horizon and willingness to experience volatility. The market is acting like there is tremendous upside potential in A.I and technology, but if you think now is a good time to increase exposure to stocks it is also crucial NOT be a goldfish and to remember that along with the potential for outsized returns comes a greater chance of loss.

As our website and marketing materials state: Wright Cove Capital strives to “develop and execute client-specific investment plans to achieve the greatest return per unit of risk.” In other words – what is appropriate for one person may not be the right investment choice for another.

We thank all our clients for their continued trust and support and wish all a great summer!

As always, if you have any questions or concerns – or would like to hear more about Wright Cove Capital, please feel free to reach out.

Regards,

Eric and Cass

Eric Leinwand, Principal – Eric@wrightcovecapital.com

Cass Tokarski, Principal – Cass@wrightcovecapital.com

The themes and strategies that we speak about and the positioning we take in portfolios are all customizable to best reflect each of our clients’ own unique goals and should not be interpreted as general investment advice.